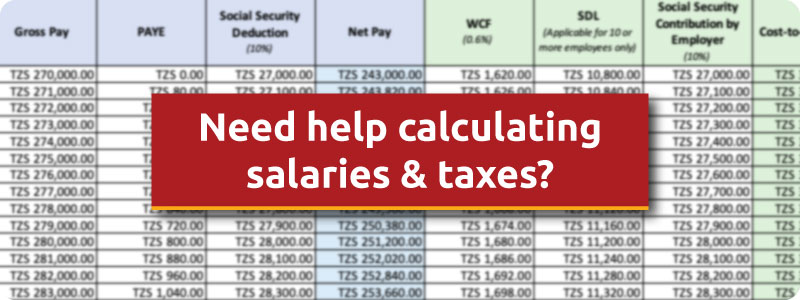

Calculating Net Salaries and relevant taxes, social security and other deductions is one of the most common tasks in any business. Yet, it is also one that creates the most confusion and often gotten wrong.

We’ve created a simple table to help you! Our complete payroll salary and tax calculation table for Tanzania includes calculations for PAYE, NSSF, SDL and WCF.

We’ve also done the extra work of calculating the complete Cost-to-Company (C2C) for you!

Disclaimer: The information below is a simplified version of the calculations of an employees salary in Tanzania based on the Finance Act of 2021/2022. It does not take into consideration other allowances or deductions that may be applicable from case-to-case. It is provoded only to serve as a guideline. SDL calculations below are only applicable if an employer meets the SDL threshold of 10 or more employees on the payroll. WCF rates provided are for the private sector and NOT the public sector. All calcuations provided are for guidance only. Please refer to the official TRA circulars, WCF circulars and NSSF circulars for changes that may happen from time-to-time. While every effort is made to ensure the accuracy of the information provided, SAC cannot be held liable for any errors or ommissions that may exist in this document..