If you are in the business of importing or exporting goods to and from Tanzania, then you have undoubtedly come across the term ‘HS Codes’. It has probably been mentioned by your supplier, and commonly used by your Freight Forwarder or Clearing Agents.

Maybe you already know what they are. But just in case you don’t, and have never had the time to ask, we will cover HS Codes for you in this article. Read on.

What exactly are HS Codes?

So, what exactly are HS Codes, and what do the letters HS mean?

HS stands for Harmonised System, ergo, Harmonised System Codes = HS Codes (for short).

The Harmonised System is an internationally standardized system that was developed in the early 80’s and first came into effect in 1988. Since then, it has been developed and maintained by the World Customs Organisation.

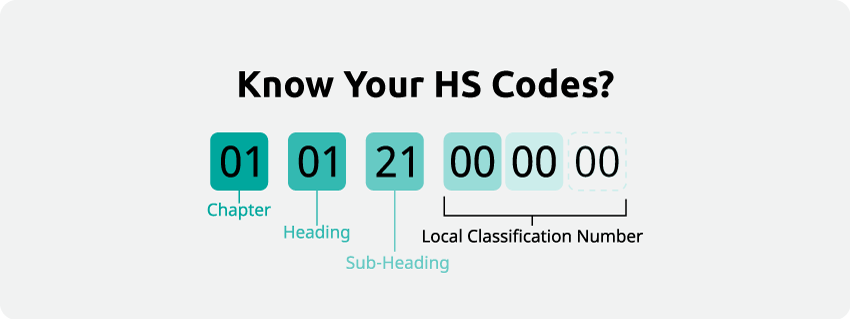

The system sets out a hierarchical structure for categorising goods into very specific groups that are then assigned a particular HS Code that best represents the nature of it. Overall, the Harmonised System is organised into 21 sections which are subdivided into 99 chapters.

The process of assigning HS codes is known as HS Classification.

How do HS Codes help?

HS Codes help in various ways. Apart from simply classifying goods into their respective categories, which can aid with logistics, processes, storage etc, it also plays a very important role in determining the application of various duties, taxes and tariffs.

In East Africa, like in most other countries in the World, the duties, taxes and tariffs applied to any product being brought into the country, or being exported out, are determined by the category of the product, and therefore it’s HS Code.

A government may, at different times, apply different duties, taxes and tariffs on certain HS Codes in line with the overall budgetary policy. It is therefore important to get the HS Codes right.

Incorrectly selecting HS Codes can have serious consequences including fines and penalties.

Who sets the HS Codes?

The HS Codes are declared by the importers and exporters, and their agents. Often, the manufacturer of the product would know exactly what HS Code to apply so a business does not need to worry about this too much.

However, while a business may declare certain HS Codes, ultimately it is within the purview of the country’s Customs and Revenue Authorities to determine if the HS Code applied is correct. In cases where some goods have been incorrectly classified, the authorities may re-assess the goods and place them under their correct classification.

Where can I find the HS Codes & related tariffs?

As part of the East African Customs Union, Tanzania imposes the EAC common external tariff on goods from non-EAC countries. The tariffs range from 0 percent for raw materials to 10 percent for industrial used goods and 25 percent for consumer goods.

The HS Codes and their related tariffs are published under the publication – EAC Common External Tariff, 2017, Harmonised Commodity Description and Coding System (Version 2017).

You can download the full EAC Common External Tariff document here.

Got questions or feedback?

Still have more questions about HS Codes and want more clarity? Write to us at [email protected] and we will help answer your questions. We are a fully fledged bookkeeping, accounting and tax consulting company that can help your business grow.